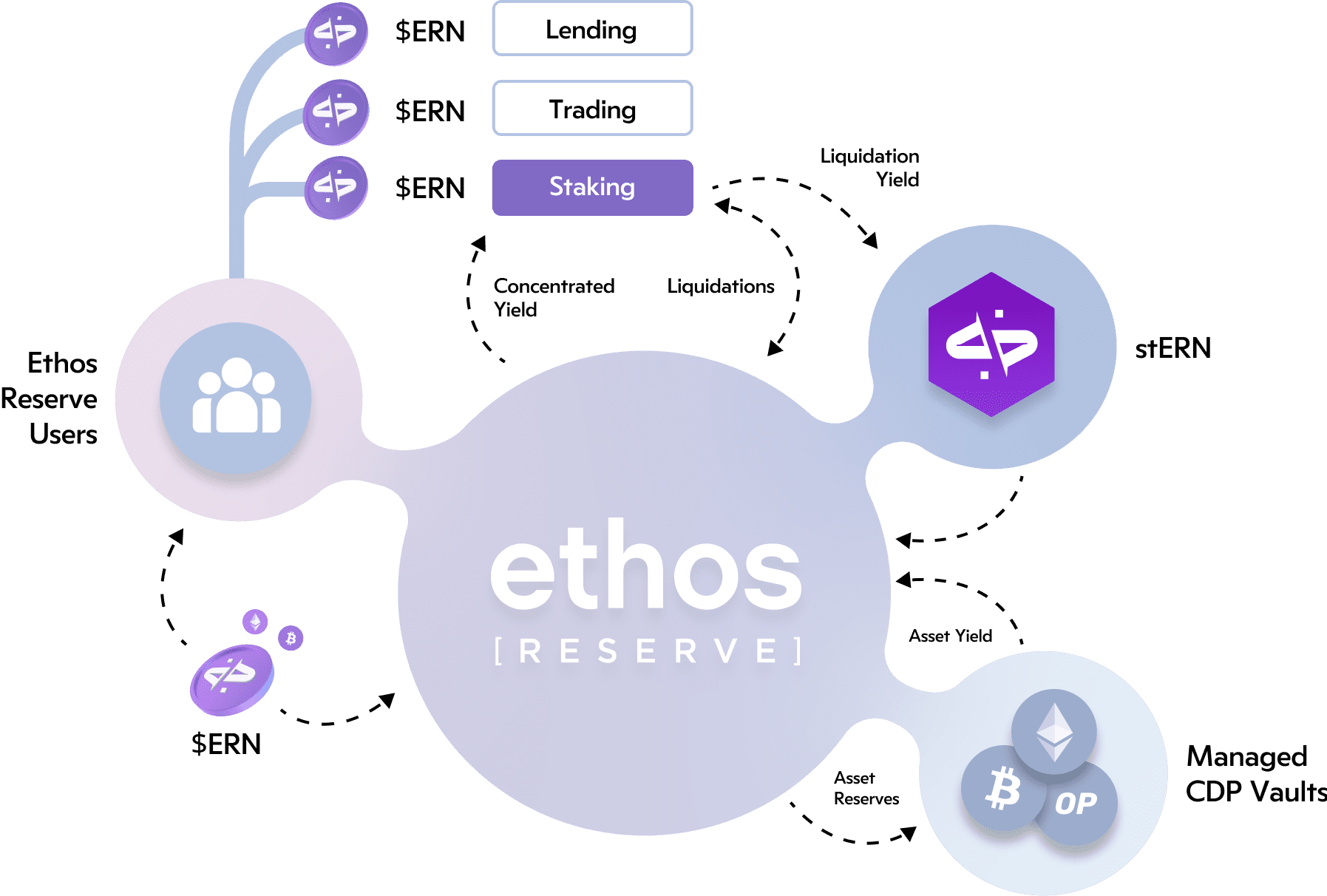

Ethos Reserve has established itself as a top DeFi protocol for collateralized debt positions (CDPs), allowing users to access loans with blue-chip crypto assets like Bitcoin (BTC) and Ethereum (ETH) held as collateral. Now, Ethos is evolving its offering with staked ERN (stERN) to expand capabilities for users.

stERN tokens are the latest addition to the Ethos Reserve tech stack, and unlock a number of powerful utilities for the ecosystem. Not only does stERN enable omnichain access to stability pool yield, but it will eventually allow for the creation of powerful leverage products through integration of stERN into DeFi lending protocols. As OATH Chapters continue to be unveiled, expect stERN to become a common denominator throughout each one alongside their own native stTokens.

Ethos Reserve allows users access to interest-free loans using BTC, ETH, and OP as collateral. It is important to note that Ethos Reserve users have the ability to capture upward price appreciation of their deposited collateral in addition to earning stablecoin (ERN) yield via the stability pool.

What distinguishes Ethos from other Collateralized Debt Position (CDP) protocols is its ability to rehypothecate what would otherwise be underutilized collateral to trusted partner lending markets or yield aggregators to capture BTC, ETH, and OP yield. The accumulated yield is then used to buy OATH off the market to distribute to the Stability Pool as incentives, creating the first sustainable CDP platform in all of DeFi.

Within the standard Stability Pool, ERN is used to liquidate under-collateralized positions in exchange for liquidated assets.

The end state is that users trade Stability Pool ERN for liquidated BTC, ETH, or OP at a discounted price. Users can then claim their rewards at any time to increase their Ethos Reserve collateral, pay off loans, create LP positions, or participate in other crypto market activities.

Now that the fundamentals of Ethos have been discussed, let’s explore the next evolution of ERN.

Ethos Reserve is leveraging Reaper technology to offer the staked ERN (stERN) vault. The stERN vault stakes ERN in the Ethos Stability Pool on behalf of users, and regularly compounds all rewards back into ERN.

The result is reduced exposure to volatile asset prices during liquidations, maintaining exposure to volatile asset yields, while gaining more underlying ERN.

An analogy would be wstETH that increases in value compared to the underlying ETH as it gains yield.

The stERN vault empowers users with an ERC-20 Liquid Staked Token (LST) that maintains its value across diverse DeFi platforms. The flexibility of stERN allows users to navigate the ever-changing DeFi landscape with confidence, secure in the knowledge that their assets are interest-bearing, with limited value downside.

stERN’s LST design means users can provide liquidity on exchanges, swap in and out of stERN, redeem stERN for ERN, and more. The possibilities are endless.

With stERN, users gain exposure to volatile asset yields from collateral while enjoying the appreciating price of compounded ERN. Whether you’re a seasoned DeFi enthusiast or just setting foot in this realm, stERN provides the opportunity to earn competitively while protecting your portfolio.

Embrace the future of DeFi and discover the power of stERN!

Ethos Reserve is a decentralized lending protocol that allows users to take out interest-free loans against collateral such as BTC and ETH. Loans on Ethos Reserve are paid in Ethos Reserve Notes (ERN), a stable asset pegged to the US Dollar. Collateral backing ERN is used to generate passive yield, which is directed toward Stability Pool depositors. These depositors secure the protocol against unhealthy collateral by depositing their ERN tokens into a pool which liquidates unhealthy positions within the system.

Ethos Reserve is a decentralized lending protocol that allows users to take out interest-free loans against collateral such as BTC and ETH. Loans on Ethos Reserve are paid in Ethos Reserve Notes, or ERN, which is a stable asset pegged to the US Dollar.

Loans drawn from Ethos Reserve require users to maintain a minimum amount of collateral in the system to cover their debt. These collateral ratios are as low as 108% for ETH, 120% for BTC, and 130% for OP, and may be lowered over time depending on usage.

Collateral backing ERN is used to generate passive yield, which is directed toward Stability Pool depositors. These depositors secure the protocol against unhealthy collateral by depositing their ERN tokens into a pool which liquidates unhealthy positions within the system.